1. Suspension of deadlines for providing information regarding transactions between residents or domiciled in Brazil and residents or domiciled abroad.

From July 01 to December 31, 2020, deadlines were suspended for providing information regarding transactions between residents or domiciled in the country and residents or domiciled abroad that comprise services, intangibles and other operations that produce variations in the net equity of individuals, legal entities or depersonalized entities (Siscoserv), as provided for in art. 3 of MDIC Ordinance No. 113, of May 17, 2012, and in art. 6 of Joint Ordinance RFB/SCS No. 1,908, of July 19, 2012.

Normative Act: SECIN/RFB Joint Ordinance no. 25, published on 07/01/2020

2. Extension – Suspension of PGFN collection administrative acts

The suspension of administrative collection acts, originally provided for in Ordinance No. 7,821, was extended until July 31, 2020.

Thus, the suspension applies to deadlines related to:

Normative Act: Ordinance No. 15,413, published on 06/29/2020

3. Extension – Extraordinary transaction

The deadline for adhering to the extraordinary transaction related to taxes registered in the Federal Government’s debt was extended to July 31, 2020.

Agreements may be entered into for paying the debt in up to 81 monthly installments (or 142 installments for individuals, micro and small companies), with down payment corresponding to 1% or 2% of the debts.

Normative Act: Ordinance no. 15,413, published on 06/29/2020; and Ordinance no. 9,924, published 04/16/2020.

4. Extension – Reduction of IOF-Credit rates to zero

Decree no. 10,414/2020, which changed the IOF Regulations, extended, to the period between 3 April 2020 and October 2, 2020, the reduction of the IOF-Credit rate (and the additional 0.38%) to zero in the following credit operations contracted in such period:

The reduction also applies in cases of extension, renewal, novation, composition, consolidation, debt confession and similar business, of a credit operation in which there is no substitution of a debtor, provided that such hypotheses occur between April 3, 2020 and October 2, 2020.

Furthermore, the reduction is also valid for operations contracted in the period indicated above, regardless of the maturity date.

If the tax basis is calculated by adding the daily debit balances, the zero rate will be applicable to the daily debit balances calculated between April 3, 2020 and October 2, 2020.

Normative Act: Decree no. 10,414/2020, published on 07/03/2020

5. Extension – Suspension of deadlines and procedures – RFB

The suspension of deadlines with the Federal Revenue of Brazil (“RFB”) was extended until July 31, 2020, especially regarding: (i) deadlines for practice of procedural acts; (ii) registration of pending regularization at the CPF due to failure to file a tax return; (iii) indication of unfitness in the registration of legal entities due to the absence of a tax return.

The deadlines for notifying the taxpayers related to individual income tax are no longer suspended.

Finally, face-to-face service, with mandatory previous appointment, was also extended until July 31, 2020, to RFB service units for the services listed in article 1 of Ordinance RFB No. 543/2020, such as installment payments and re-installment payments not available on the internet, payment rectifications, among others.

Normative Act: Ordinance RFB 1087, published on 06/30/2020

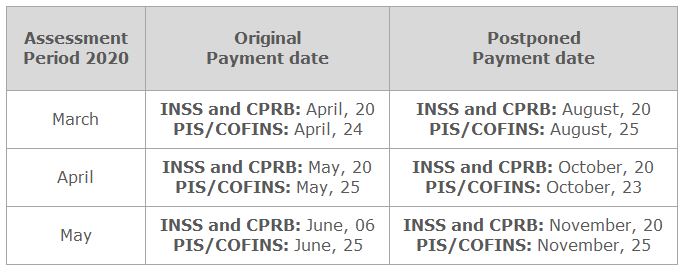

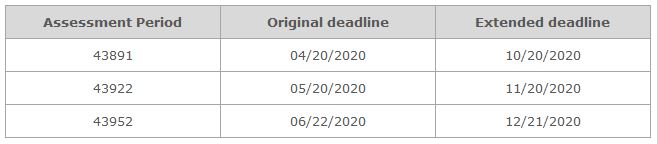

6. Federal contributions regarding taxable events of May/2020 (INSS and PIS/COFINS) – Deadline extension

The deadline for payment of the social contributions due by the employer and RAT “INSS” (Sections 22, 22-A, 24 and 25 of Law N. 8.212/91) and substitutive social contribution (“CPRB”) regarding the assessment period of May, 2020 was extended to October 2020.

Considering such measure and the Ordinances 139 and 150 enacted earlier this year, the due dates for payments of social contributions were extended as follows:

Normative Act: Ordinance N. 245/2020

7. Special tax settlement for outstanding federal debts

The Office of the Attorney-General of the National Treasury enacted new rules setting forth the special tax settlement for outstanding federal debts. Please find below the requirements for enrolling to the special tax settlement:

i) installment payments of up to 133 installs, depending on the taxpayer situation.

iii) discounts on interest, fines and charges up to 100% depending of the recoverability of the debt with certain conditions.

The period for enrolling into this program is from the 1st of July 2020 to the 29th of December 2020.

Normative Act: Ordinance No. 14,402/2020.

8. Suspension of administrative proceedings and changes/extension of procedures before the Federal Brazilian Tax Authorities

The administrative proceedings within the Federal Brazilian Tax Authorities (RFB) were suspended until June 30, 2020, specially regarding: (i) practice of acts on administrative proceedings; (ii) individual taxpayers’ register (“CPF”) proceedings due to non-compliance of ancillary obligations; (iii) register of disability on the Corporate Taxpayer ID number due to non-compliance of ancillary obligations.

Proceedings listed in Items II to IV of Article 8 of Ordinance RFB No. 543/2020 were not suspended, such as the special proceeding for verifying the origin of resources applied in foreign trade operations and combating fraudulent interposition by persons, acts involving judicial determinations, among others.

Also, the electronic issuance of administrative orders on proceedings involving refunds, offsetting or reimbursements are no longer suspended.

Finally, face-to-face attendance, with mandatory prior appointment, was extended to RFB service units for the services listed in article 1 of RFB Ordinance No. 543/2020, up to 6/30/2020, such as installment payments not available on the internet, payment amendments, among others.

Normative Act: Ordinance ME 936, issued on 5/29/2020

9. Tax on Financial Transactions – Tax rate reduction for credits transactions

Decree N. 10,377/2020 (dated May 27, 2020), modified the Tax on Financial Transactions (IOF) Regulations to reduce to zero the rate for the following credit transactions:

1. transactions made through the Studies and Projects Financing Agency (FINEP) or its financial agents, with FINEP’s resources;

2. transactions related to the financing of logistics infrastructure projects destined to road and railroad works made by concession of the Federal Government;

3. transactions contracted by the Electric Energy Trading Chamber (CCEE), intended to cover, total or partially, the deficit and the advance of revenue, incurred by the Public Services Agencies and Licensee of public electricity distribution services, for taxable events up to 12/31/2020.

Moreover, the Decree revoked the old item XXIX of the caput of art. 8 of the IOF Regulation, which reduced to zero transactions contracted by CCEE intended to cover expenses incurred by concessionaires, which were not necessarily linked to deficit or advanced revenue.

Normative Act: Decree No. 10,377, issued on 5/28/2020.

10. Export Processing Zones

Companies authorized to operate in an Export Processing Zone (SPA) are exempt, specifically for the 2020 calendar year, from the obligation to earn and maintain the minimum percentage of gross export revenues of 80% (eighty percent) from the total gross revenues arising from sales of goods and rendering of services.

This relevant change was provided in Provisional Measure No. 973, issued on 5/28/2020.

Normative Act: Provisional Measure No. 973, issued on 5/28/2020.

11. Digital Accounting Bookkeeping – Extension

The deadline for filing the Digital Accounting Bookkeeping (ECD), with original due date scheduled for the last business day of May 2020, was extended to the last business day of July 2020, including in the events of termination, merger, consolidation or spin-off of the company.

Normative Act: Normative Instruction No. 1,950, issued on 05/13/2020.

12. Federal tax installment agreements – Extension for Installment Payments

On May 12, 2020, the Ministry of Economy published Ordinance No. 201 (dated May 11, 2020) providing the extension for payment of Federal tax installments, to the last business day:

The extension does not cover installments of taxes under the Simples Nacional regime, does not exclude interest and solely covers maturing installments due since the publication of the Ordinance.

Normative Act: Ordinance No. 201, issued on 5/12/2020.

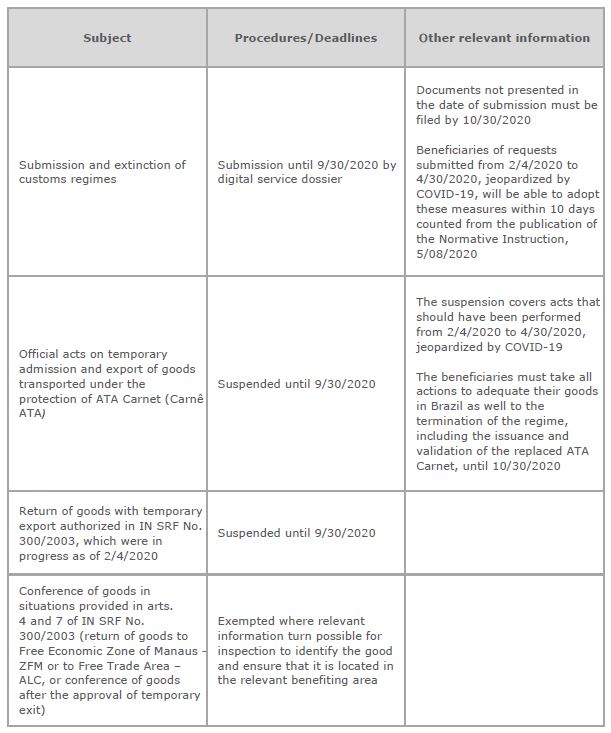

13. Procedures and extensions for special customs regimes and regimes applied in special areas during COVID-19

On May 8, 2020, the Federal Brazilian Tax Authorities (RFB) published the Normative Instruction No. 1,947/2020 (dated May 7 2020) providing procedures and deadlines for submission, regularization and termination of special customs regimes, and regimes applied in special areas during the state of emergency of international concern of COVID-19, as follows:

Finally, the IN also allows the 2nd Regional Superintendence of RFB (SRRF02) to permit the digital submission of the Definitive Exporting Statement and its relevant related documents provided in IN SRF No. 300/2003.

Normative Act: Normative Instruction No. 1,947, issued on 5/8/2020.

14. Suspension of taxes granted in special drawback regimes – Deadline extension

Published on 5/4/2020, Provisional Measure (MP) No. 960 extends for one year the suspension of taxes granted under special drawback regimes provided in art. 12 of Law No. 11,945/2009.

Through Concession Acts of special drawback regimes, the import of goods for employment or consumption in the manufacturing of the product to be exported can be carried out with the suspension of customs duty (II), Excise Tax (IPI), PIS / Pasep-Import and Cofins-Import.

The new extension applies for acts that have already been extended for one year by tax authorities, ending in 2020.

Normative Act: Provisional Measure No. 960, issued on 5/4/2020.

15. Taxes on telecommunications services – Deadline payment extension

As per the Provisional Measure (MP) N. 952, the deadline for collecting the following taxes on telecommunication services was extended to 08/31/2020, for debts with the original due date of 03/31/2020:

These taxes may be collected in a lump sum or in 5 (five) monthly installments, adjusted by the SELIC rate without any additional interests or fines, with the first installment due on 8/31/2020.

Normative Act: Provisional Measure N. 952, issued on 04/15/2020

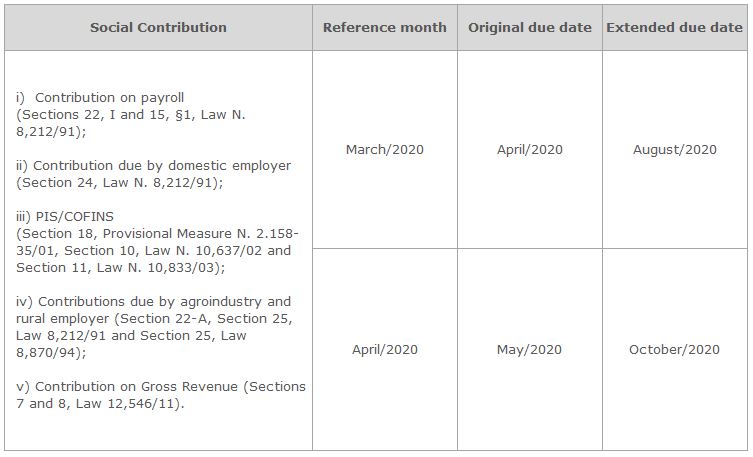

16. Social contributions – Deadline payment extension

The deadline for collecting the social contribution on payroll, contribution to PIS/Pasep and Cofins, social contributions for the agroindustry and rural employers (Funrural) and social contribution on gross revenue was extended regarding to the reference months of March and April 2020, as follows:

Normative Act: Ordinance N. 139, issued on 04/03/2020 and Ordinance N. 150, issued on 04/08/2020.

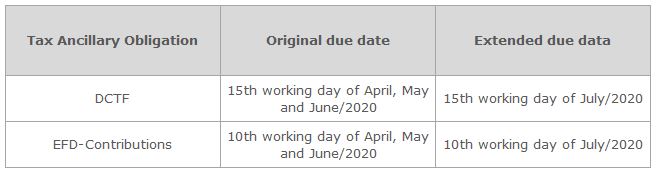

17. Tax Ancillary Obligations – Deadline extension

The deadline for filing the Federal Taxes and Social Contribution Debts and Credits Return (“DCTF”) and the Social Contributions Return for PIS/Pasep, COFINS and Social Contribution on Revenue (“EFD-Contributions”) was extended, as follows:

Normative Act: Normative Instruction N. 1,932, issued on 04/03/2020

18. Individual Income Tax Return – Deadline extension

The deadline for individuals filing Income Tax Returns and to start paying any residual amount of income tax was extended to June 30th, 2020. According to the Brazilian Federal Revenue Secretary, the deadline was extended in order to allow taxpayers to gather all documents necessary to prepare Tax Returns. In addition, the obligation to inform the receipt number of the last tax return will not be mandatory for 2020 Tax Return.

Normative Act: Normative Instruction N. 1,930, issued on 04/01/2020

19. Tax on Financial Transactions – Tax rate reduction for credits transactions

Decree N. 10,305/2020, issued on 04/02/2020, modified the Tax on Financial Transactions (IOF) Regulations in order to reduce to zero the rate for the following credits transactions performed between April 3rd, 2020 and July 3rd, 2020:

a) loan transactions, under any condition, including credits and funding subject to the release of funds in installments;

b) discount transactions, including sales transactions to factoring’ companies from credits negotiated in installments;

c) advance to depositors;

d) limits surplus, including whether the agreement has matured; and,

e) commercial real estate funding for individuals.

Moreover, the tax reduction is also applicable to extension, novation, consolidation or confession of credit transactions, and similar arrangements, provided that debtor is not replaced and the renegotiation occurs between 04/03/2020 and 07/03/2020.

The reduction is applicable for transactions executed within the mentioned period regardless of their maturity.

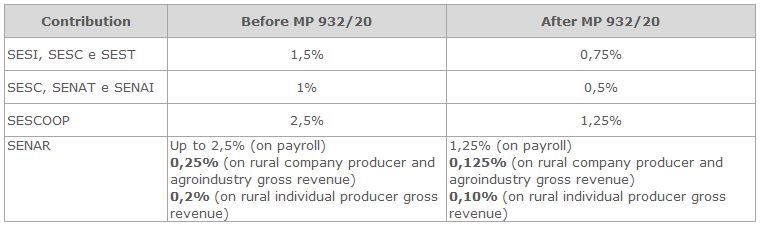

20. Reduction of contributions to “System S”

The Provisional Measure (MP) N. 932/20 provides a reduction of the rates of social contributions to certain entities of the so called “System S” (from April 1st, 2020 to June 30th, 2020), as follows:

21. II and IPI tax rates reduction to zero

The Import Tax (II) and the Excise Tax (IPI) tax rates were reduced to zero to medical and hospital products such as ethylic alcohol, disinfectants, antiseptic gel, protective clothing and accessories, plastic, electrodiagnostic devices, laboratory and pharmacy items, thermometers, gloves etc.

Normative Act: Resolution CAMEX N. 17, issued on 03/18/2020, Resolution CAMEX N. 22, issued on 03/25/2020, Decree N. 10,285, issued on 03/20/2020, Decree N. 10,302, issued on 01/04/2020 and Resolution CAMEX N. 30, issued on 04/08/2020.

22. Simples Nacional – Deadline extension

The payment deadline for federal taxes (PIS and COFINS contributions, IPI, IRPJ, CSLL, CPP), under the Simples Nacional tax regime were extended, as follows:

Normative Act: Resolution from SIMPLES Committee N. 152, issued on 03/18/2020

23. Validity extension of Debt Clearance Certificate issued by RFB/PGFN

The validity of Negative Debt Clearance Certificate (“CND”) and Positive Debt Clearance Certificate with Negative Effects in force on March 23, 2020 issued by the Brazilian Federal Revenue (“RFB”) and by the Attorney General’s Office of the National Treasury (“PGFN”) was extended for 90 days.

Normative Act: Ordinance RFB/PGFN N. 555, issued on 03/24/2020

24. Taxation on currency exchange fluctuations on investments of financial institutions in controlled foreign companies connected with hedge transactions

Among other provisions, Provisional Measure N. 930/20 determines the inclusion by financial institutions of currency exchange fluctuations on investments in CFCs corresponding to the portion hedged in the corporate income tax and social contribution on net profits basis, in the following proportions: (a) for 2021, 50%; and (b) from 2022 on, 100%.

Normative Act: Provisional Measure N. 930, issued on 03/30/2020

25. Suspension of deadlines and procedures before the Federal Revenue Service

The administrative proceedings within the Federal Revenue Service were suspended until May 29, 2020. Also, the following were suspended: the electronic collection notifications, individual income tax notifications, tax installment agreements notifications, individual taxpayers’ register (“CPF”) proceedings regarding non-compliance of ancillary obligations, among others.

Normative Act: Ordinance RFB 543, issued on 03/23/2020

26. Administrative acts of collection from the National Treasury Attorney-General’s Office (PGFN)

PGFN determined the suspension, up to 90 days, of the deadlines in the situations bellow:

(a) administrative defense and appeal against a decision filed in an Administrative Procedure for Recognition of Responsibility – PARR;

(b) defense of non-conformity and appeal against the decision rendered in the exclusion process from the Special Tax Amnesty Program – PERT;

(c) early offer of guarantee for tax enforcement actions;

(d) Request for Review of Registered Debt – PRDI and appeal against the decision that rejects it;

(e) to protest against overdue liabilities certificate;

(f) establishment of new Administrative Procedures for Recognizing Liability – PARR;

(g) commencement of procedures for the exclusion of taxpayers from tax installment agreements managed by the Attorney General’s Office of the National Treasury due to lack of installment payment.

Normative Act: Ordinance N. 7.821, issued on 03/18/2020

27. Extraordinary transaction – Extension

PGFN established an extraordinary tax installment plan to collect tax debts already enrolled in the list of executable overdue debts, including debts already encompassed on other tax installment agreement programs. The current program involves payments in up to 97 installments (for individuals, individual entrepreneurs, and micro and small businesses), with a down payment equivalent to 1% or 2% of the total debt. The deadline for applying for this transaction was extended until Provisional Measure No. 899/2019 loses its force.

Normative Act: Ordinance N. 7,820, issued on 03/18/2020 and Ordinance N. 8,457, issued on 03/25/2020

Our tax practice is available for any clarification required and to assist in respect of the measures above.