On April 1st, 2020, the Executive Order No. 936 (MP 936) was enacted, instituting the Federal Government Emergency Employment and Income Maintenance Program. The MP 936 authorizes the proportional reduction of wages and working hours and the suspension of the employment contract through an individual agreement between the employee and employer, without the participation of the labor union and through collective bargaining agreemens.

1. Reduction of wages and working hours

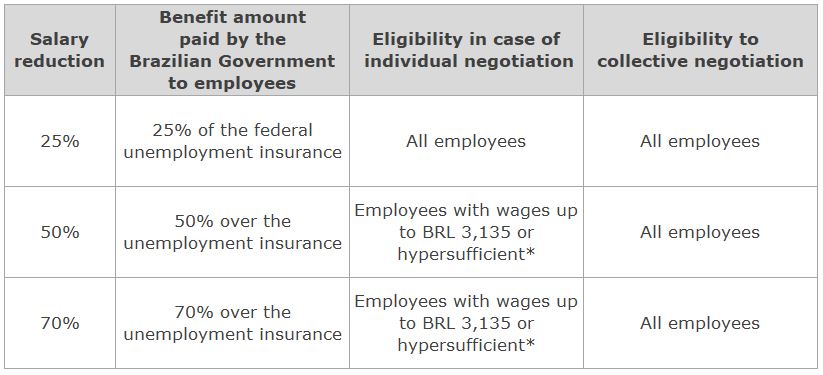

According to the text to MP 936, the reduction of wages and working hours through individual agreements is authorized under the following scenarios and limits:

(i) reduction of 25% of the salary and working hours for any employee; and

(ii) reduction of 25%, 50% or 70% of salary and working hours for employees with a salary up to BRL 3,135 or employees with broad negotiation autonomy (hypersufficient)*

The individual agreements must be formalized in writing and the company’s proposal must be submitted to employees at least 2 days before its implementation. The company is also required to send a copy of such agreements to the labor union and the Ministry of Economy within 10 days of signing the individual agreement.

The reduction through collective bargaining can cover all employees and reduction percentages.

The salary reduction must necessarily be equal to the working hours reduction, without reduction of the equivalent hour rates of employees and may be in force to a maximum term of up to 90 days.

The wages and working hours reduction is conditioned to a temporary job guarantee during the term in which the reduction remains in force and a for a later term corresponding to the period in which the salary remained reduced (for example: salary reduced from April 1 to May 31 results in job guarantee from April 1 to July 31).

* Employees who receive salaries from BRL 12,202.12 and have a college degree are considered employees with broad negotiation autonomy (hypersufficient).

2. Suspension of employment agreement (Layoff)

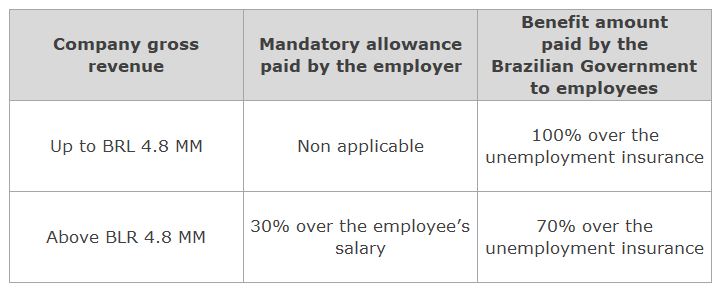

Temporary suspension of employment agreement without payment of salaries is authorized thought:

a. Individual agreement for employees with wages up to BRL 3,135 or hypersufficient*. Individual agreements must be formalized in writing form and the company’s proposal must be submitted to employees at least 2 days before implementation of the proposed alteration

b. Collective bargaining for all employees.

In any case, the suspension of the employment agreement must last a maximum of 60 days (which may be split in two 30-day terms) and companies must maintain benefits granted to active employees (e.g. food vouchers, meal vouchers).

During the suspension, the employee must not perform activities for the employer, under penalty of the suspension being recognized as null and void; the employee will be entitled to a job tenure during the suspension and a for a later period corresponding to the period in which the employment agreement remained suspended.

The company must pay an allowance, depending on whether its gross revenue in the previous period:

The maximum salary reduction and suspension of employment term, during the COVID-19 crisis cannot exceed 90 days per employee. Therefore, in case the employer implements the suspension of employment (layoff) for 60 days, later salary reductions will be limited to 30 days.

3. Emergency Employment and Income Preservation Benefit (BEPER)

MP 936 also institutes BEPER, which will be a social security benefit funded by Federal Government resources and will be paid to employees whose wages have been reduces or employment agreement have been suspended. The BEPER will be calculated on the monthly amount of unemployment insurance that the employee would be entitled to if terminated and will not impair the application to or reduce the amount of unemployment insurance if the employee is dismissed in the future.

For employees whose wages have been reduced, the BEPER will be paid at the same percentage as the wage reduction (e.g. an employee with a 50% salary reduction will receive 50% of the BEPER for the duration of the reduction).

Working hours and wages will be immediately restored if (i) the state of public calamity ceases; (ii) the period of salary reduction or suspension of the contract reached their terms; or (iii) by decision of the employer to terminate the salary reduction or suspension of the contract.

Upon its enactment, MP 936 was submitted to the National Congress for approval and confirmation. Such process should occur within a maximum of 120 days, otherwise MP 936 ceases to be enforceable. In view of its dispositions, especially regarding the reduction of wages and hours through individual agreements, it is likely that the constitutionality of such provisions will be questioned before the Brazilian Supreme Court.

We will continue to follow up this matter and its developments.