On November 27, 2019, it was enacted Provisional Measure 907 (PM 907) which, in addition to ruling out the collection of copyrights by the Brazilian Central Collection and Distribution Agency (“ECAD”) with regard to the execution of artistic, literary and scientific works in hotel and ship rooms and cabins, and to the incorporation of Brazilian Agency for International Tourism Promotion (Embratur) as a not-for-profit private legal entity in order to improve tourism in Brazil, it also implemented changes on taxation of international aircraft leasing and on the remittances of funds destined to cover personal expenses abroad.

Pursuant to the previous wording of Article 16 of Law No. 11,371/2006, the remittance of funds abroad in consideration for aircraft or aircraft engine leasing, entered into by a airline dedicated to public transport of passengers or cargo until December 31st, 2019, with taxable events occurring up to 12/31/2022, were subject to withholding income tax (WIT) at a zero percent (0%) rate.

For this reason, if a new legislation was not enacted extending its effects, the benefit of 0% withholding tax would not apply to such leasing entered into from January 1st 2020 on, which would result in application of a 15% WIT rate, with an increase of cost to lessees under gross-up clauses provided in the agreements.

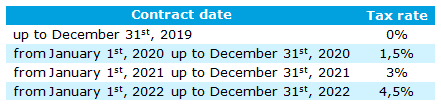

Even though it did not maintain the zero percent (0%) tax rate benefit, PM 907 established WIT reduced rates which will be increased over time until December 31st, 2022. Pursuant to PM 907, WIT will progressively increase according to the contract date, until it reaches the maximum rate of 4.5%, as provided below:

In principle, for agreements entered into from January 1st, 2023 on, and for any remittances made as of this date, regardless of when the corresponding contract was entered into, WIT will be levied at a 15% rate, but it is possible that a new legislative change is implemented to benefit airlines before that, a matter that must be followed.

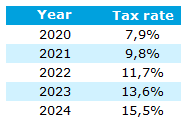

In addition, PM 907 did not allow the application of the 25% general WIT rate, at least until 2024, on remittances of funds abroad destined to cover personal expenses of individuals residing in Brazil, on tourism, business, services, training or official missions, up to $ 20,000 per month. However, PM 907 did not maintain the current 6% WIT rate valid until December 31st, 2019. As of January 1st, 2020, the WIT will be slightly higher, as follows:

Finally, according to PM 907, the changes in the applicable WIT rate on the remittance of funds abroad destined to cover personal expenses, as well as for international leasing agreements in the situations above mentioned, will only be effective when it is attested, by an act of the Minister of Economy, its compatibility with the fiscal results provided for in the Annex to the Budgetary Guidelines Law and its compliance with Supplementary Law 101/2002.

We are at your disposal to advise you on the comprehension and implementation of this new legislation.